The most popular source of income is employment income, but it's important to think about all the different ways you make money. These are just recommendations of some of the things that might be included. Keep in mind that you do not have to include these categories in your personal budget.

Here are some recommended budgeting categories to help you organize your budget.

The IRS does not look kindly on mixing the two together, so make sure you make a separate business budget. If you have a business, it's imperative to keep your business budget separate from your personal budget. Having one simple category titled “clothes” will be okay. If you have problems areas in your budget, like spending too much money on food related items, then I would suggest breaking things down into eating out, groceries, lunch, etc. If you don't spend a lot of money on clothes, there is no need to break things down into shoes, work, gym, dresses, etc. The most important thing to remember when choosing which categories to use is to keep things simple. If you are paying close attention to your spending, you are more likely to catch fraudulent charges or billing errors. Catching mistakes becomes easier as well. Breaking things down will give you powerful insight into where your money is actually going and spending areas that might be causing problems. If you are just starting out and are creating a brand new budget, I do recommend breaking your categories down. Crazy right?īreaking your categories down has a lot of useful benefits. If you are an experienced budgeter like me, you might end up using both methods at the same time. So, the question becomes which method is the best? The truth is, it depends. For example, instead of just listing “food” as one of their categories in their budget, people will list eating out, groceries, kid's lunches, etc. The second way people use categories in their budget is by breaking each category down and allocating money towards each particular thing. Read: 3 Spending Habits That Are Setting You up for Failure.Most people believe this simplifies their budget and saves time. For example, in your budget, you might only have one line item titled “utilities” instead of breaking it down into all of the smaller categories like cell phone, water, sewer, gas, electricity, etc. The first way is by lumping all categories into a single master category. Throughout my budgeting journey, I have realized there are two ways to organize your budget using categories. What things are worthy of your hard-earned income? Ultimately, when choosing your budget categories, you are choosing what's important and what's not.

Money manager ex budget categories how to#

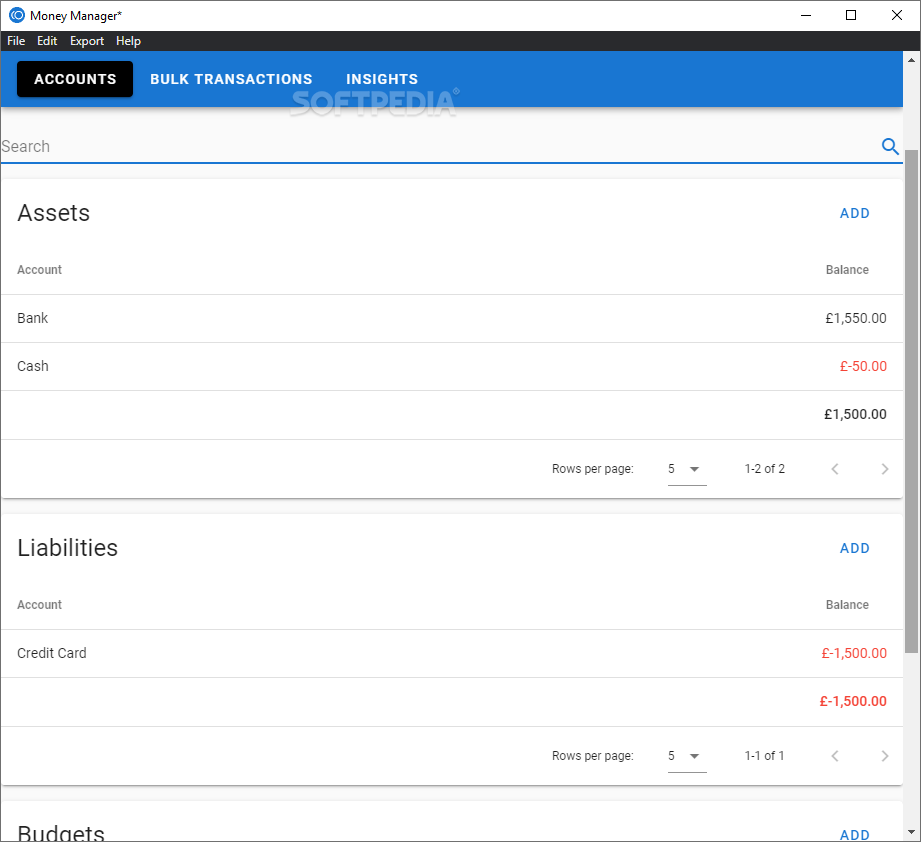

By assigning money towards different categories, you not only make sure basic needs are met, but you get to choose how to spend the money that you do have. The way you organize your budget is critical because it will ultimately help you allocate your future money towards expenses that have not happened yet. Since my first budget back in 2011, I have changed the way I organize my budget at least a half a dozen times. If you want your budget to be effective, you need to organize it in a way that is easy to understand.

0 kommentar(er)

0 kommentar(er)